Microsoft Hikes Xbox Prices; Analysts Predict PlayStation Increases

A few weeks ago, Microsoft raised the prices of all its Xbox Series consoles and many accessories globally, while also signaling that select new titles would retail for $80 this holiday season. Just days prior, PlayStation followed a similar path by increasing console prices in certain regions. Earlier still, Nintendo quietly raised the cost of its Switch 2 accessories and confirmed its first $80 game.

In short, tariff-driven price increases have officially arrived, and as each news story rolls in, it becomes increasingly difficult to track the rising costs across hardware, software, and peripherals. In an effort to understand the full scope of these changes—and what they mean for gamers—I consulted with several industry analysts. The consensus? While no major platform or publisher is going anywhere, the era of affordable gaming may be coming to an end.

Why Are Prices Going Up?

The primary reason behind Microsoft’s recent pricing adjustments is tariffs—specifically those tied to U.S. trade policy under former President Donald Trump, which continue to fluctuate unpredictably. Additional factors include rising manufacturing and development costs, but tariffs remain the dominant driver.

“Microsoft's consoles are made in Asia, so who can really be surprised about these increases?” asked Dr. Serkan Toto, CEO of Kantan Games, Inc. He noted that Microsoft strategically timed the global price hike to coincide with a period of economic uncertainty, minimizing consumer backlash by bundling multiple increases into a single announcement rather than stretching them out over time.

Joost van Dreunen, NYU Stern professor and author of the SuperJoost Playlist newsletter, echoed this sentiment: “Microsoft is ripping off the Band-Aid all at once rather than death by a thousand cuts. Their synchronized global price adjustment is a strategic recalibration in response to tariff pressures, not just incremental market testing.”

Other analysts pointed out that Microsoft’s decision to raise prices early ahead of the holiday season gives partners time to adjust while allowing consumers to recalibrate expectations. Rhys Elliott of Alinea Analytics added that increased game prices help offset higher hardware production costs, stating, “If one part of the business sees rising costs, balancing elsewhere is necessary.”

Piers Harding-Rolls of Ampere Analytics noted additional contributing factors: inflation, supply chain issues, and the fact that both Sony and Nintendo had already raised their prices. “Even with a 27% increase in the U.S., the cheapest Xbox Series S remains $70 cheaper than the Switch 2, giving Microsoft plenty of room to move up,” he said.

Is PlayStation Next?

Most analysts believe it’s only a matter of time before Sony follows suit with its own price increases on hardware, accessories, and games. Rhys Elliott was particularly confident, especially regarding $80 titles: “This is just the beginning. With Nintendo and Xbox raising software prices, the floodgates are open. Every publisher that can charge $80 will do so.”

Elliott added that higher base prices could lead to more flexible pricing models, including premium launches at $80 followed by gradual discounts to maximize long-term sales. “For similar reasons, I expect to see games launching at $80, maximizing launch sales among superfans, then the price decaying over time,” he explained.

Daniel Ahmad of Niko Partners noted that Sony has already raised PS5 prices outside the U.S., suggesting that a domestic increase isn’t far behind. James McWhirter of Omdia agreed, stating that Microsoft’s decision opens the door for Sony to follow, though the U.S.—being the largest console market—remains a sensitive territory for such moves.

Are Video Games Still Affordable?

Despite concerns that rising prices might deter buyers, most analysts don’t believe this will significantly reduce overall spending on video games. As Rhys Elliott put it, “The market will bear it.”

Elliott and others emphasized that gamers tend to be price-inelastic, meaning they’ll continue to spend even during tough economic times. However, there may be a shift in how money is spent—with fewer full-price purchases and more investment in subscriptions, discounted bundles, and live-service games.

James McWhirter noted that publishers will likely continue to explore post-launch monetization strategies, including frequent discounts, DLC, and tiered pricing. Meanwhile, Mat Piscatella of Circana remained cautiously skeptical, warning that broader economic pressures could force consumers to cut back on discretionary spending like gaming.

“As prices rise in everyday categories like food, gas, shelter, and automotive, there will be fewer dollars available for gaming in the U.S.,” Piscatella warned. “I can easily see a high single-digit percentage decline, or even into the teens, depending on how other variables play out.”

Ultimately, while the future of gaming remains bright, the financial burden on players is growing. And with tariffs, inflation, and corporate strategy all playing a role, the next year could mark a turning point in how we perceive—and pay for—the games we love.

-

1

GTA 6 Set for Fall 2025 Release, CEO Confirms

Apr 03,2025

-

2

Top Streaming Platforms for Live Sports in 2025

Jun 18,2025

-

3

First ALGS in Asia Emerges in Japan

Jan 19,2025

-

4

Roblox: CrossBlox Codes (January 2025)

Mar 04,2025

-

5

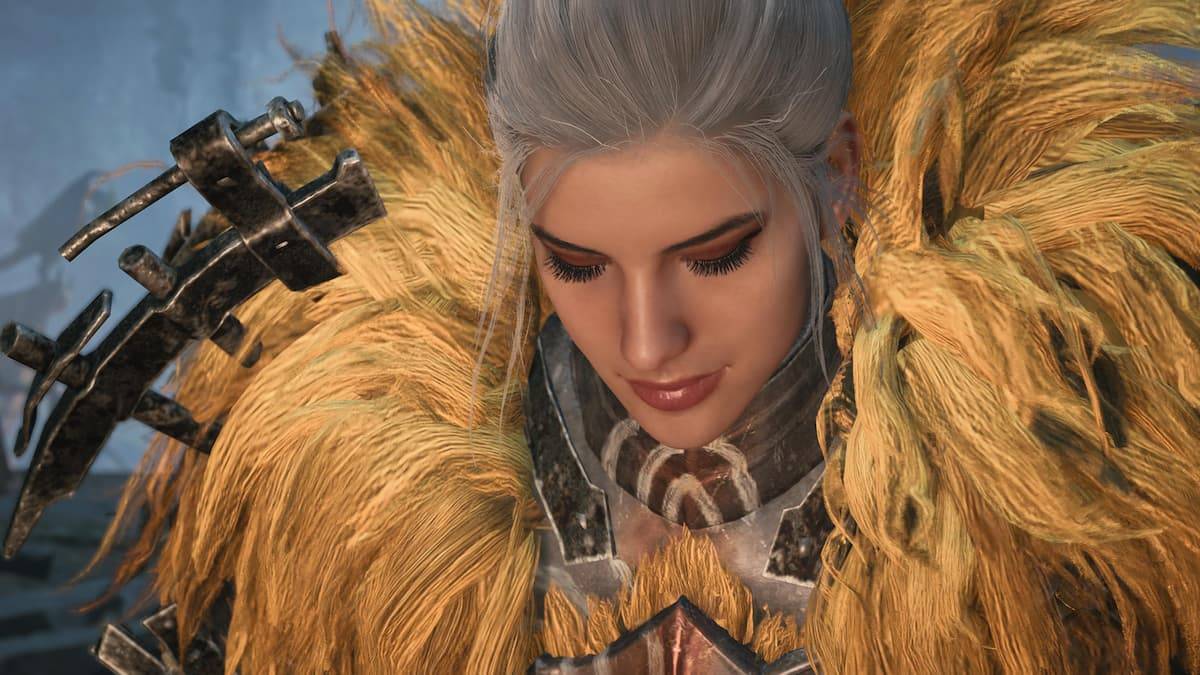

Introducing the Ultimate Guide to Seamless Character Swapping in Dynasty Warriors: Origins

Feb 25,2025

-

6

![Roblox Forsaken Characters Tier List [UPDATED] (2025)](https://img.jdzca.com/uploads/18/17380116246797f3e8a8a39.jpg)

Roblox Forsaken Characters Tier List [UPDATED] (2025)

Mar 05,2025

-

7

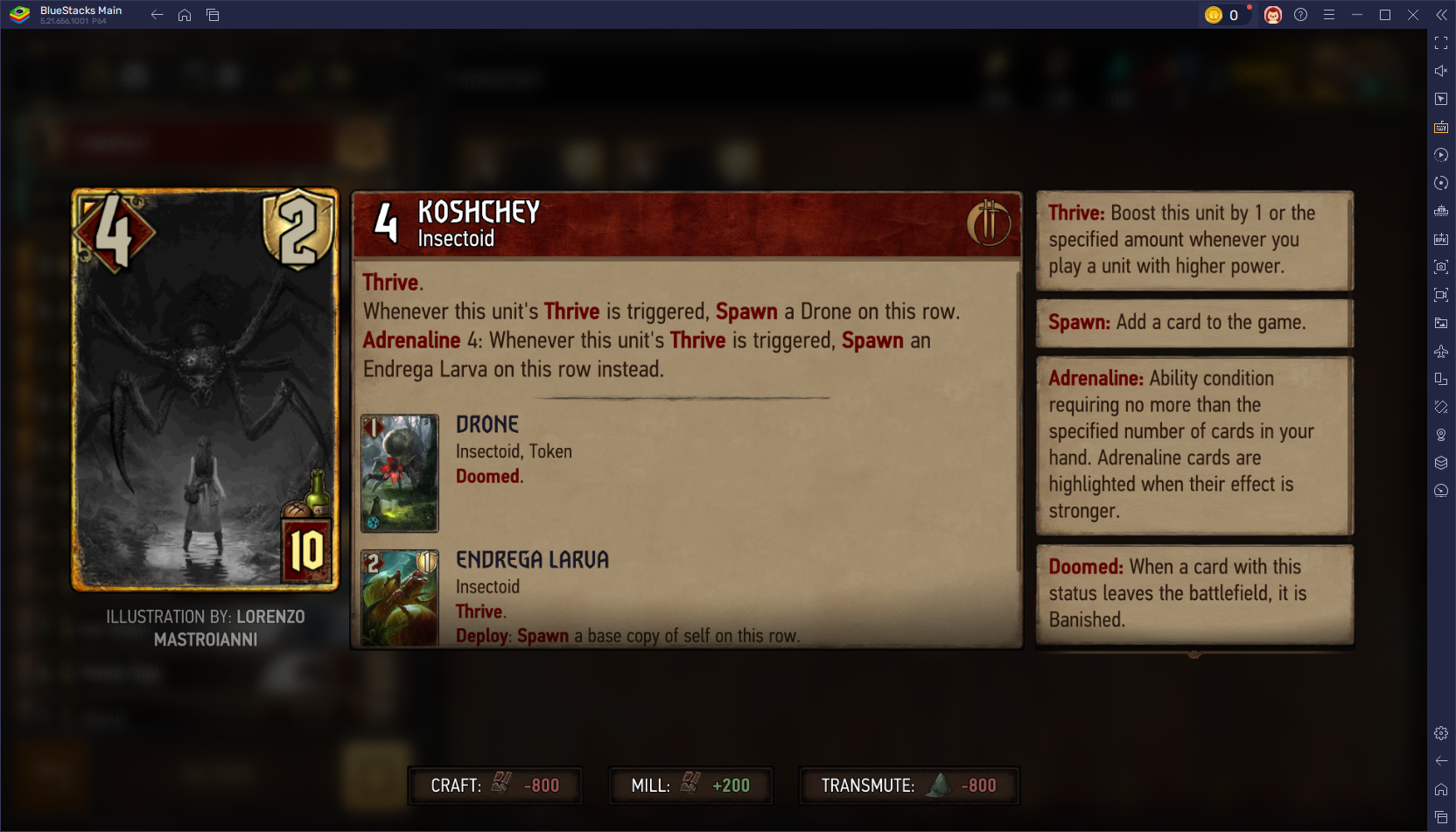

Gwent: Top 5 Witcher Decks (2025 Update)

Mar 13,2025

-

8

Max Hunter Rank in Monster Hunter Wilds: Tips to Increase

Apr 04,2025

-

9

Cute mobs in Minecraft: pink pigs and why they are needed

Mar 06,2025

-

10

Capcom Spotlight Feb 2025 Showcases Monster Hunter Wilds, Onimusha and More

Apr 01,2025

-

Download

Portrait Sketch

Photography / 37.12M

Update: Dec 17,2024

-

Download

Friendship with Benefits

Casual / 150.32M

Update: Dec 13,2024

-

Download

F.I.L.F. 2

Casual / 352.80M

Update: Dec 20,2024

-

4

[NSFW 18+] Sissy Trainer

-

5

Pocket Touch Simulation! for

-

6

슬롯 마카오 카지노 - 정말 재미나는 리얼 슬롯머신

-

7

Chubby Story [v1.4.2] (Localizations)

-

8

Life with a College Girl

-

9

Shuffles by Pinterest

-

10

Hunter Akuna