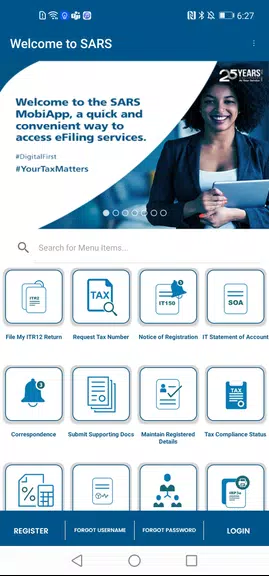

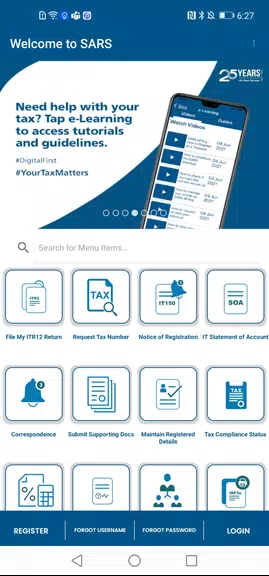

The SARS Mobile eFiling App revolutionizes tax compliance in South Africa, offering taxpayers a seamless and efficient way to file Income Tax Returns directly from their devices. This cutting-edge app enables users to retrieve annual tax returns, save drafts locally, utilize an integrated tax calculator for instant estimates, and track submission statuses—all while ensuring robust data security. Designed for modern lifestyles, it transforms tax filing into a flexible, on-the-go experience.

Key Benefits of SARS Mobile eFiling:

- Convenience: File your annual Income Tax Returns effortlessly via smartphone, tablet, or iPad with streamlined submission processes.

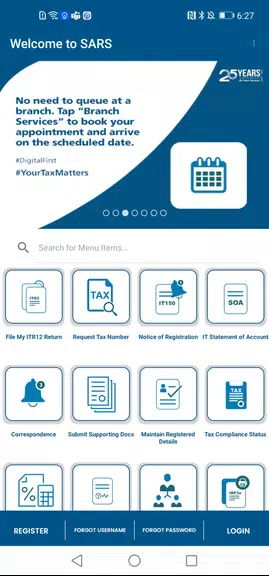

- Accessibility: Manage tax obligations remotely with 24/7 access, eliminating location and time constraints.

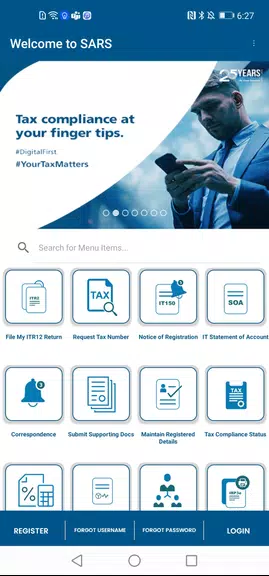

- Security: Enterprise-grade encryption protects sensitive financial data throughout the filing journey.

- Tax calculator: Instant assessment projections help users make informed financial decisions before final submission.

Frequently Asked Questions:

- Is the SARS Mobile eFiling app secure?

Absolutely. The app employs advanced encryption protocols to safeguard all transmitted taxpayer information.

- Can I access my past tax returns through the app?

Yes. The app provides access to historical Notice of Assessment (ITA34) documents and Statement of Account (ITSA) summaries.

- Can I use the app to file my business taxes as well?

Currently, the mobile platform exclusively supports personal Income Tax Returns for individual taxpayers.

Final Thoughts:

Combining user-friendly design with military-grade security, the SARS Mobile eFiling app eliminates traditional tax filing hurdles. Its intuitive interface accommodates both first-time filers and experienced taxpayers, delivering unparalleled convenience. Empower your financial management—download now to handle tax obligations anytime, anywhere.

2.0.78

142.10M

Android 5.1 or later

air.za.gov.sars.efiling